YouTube is Thriving. Advertising on YouTube Remains...Complicated

A look at the massive ecosystem supporting the world's largest video platform

After a few shaky quarters, YouTube is on a roll.

The question remains however - is YouTube getting its fair share of media dollars? A less obvious question: is the sprawling nature of YouTube advertising, coupled with the legacy buying structure found at many agencies and brands - holding YouTube back?

A few weeks ago, Alphabet reported that YouTube ad revenue had jumped 12.5% year over year, to nearly $8 billion. TV’s loss appears to be YouTube’s gain - at least at the moment.

Clearly, YouTube has made major inroads over the past few years when it comes to being considered a viable outlet for ‘TV dollars’ - thanks in large part to its huge and growing consumption on actual TV sets.

However, the YouTube landscape is not just centered around CTV. In fact, there are many ways for marketers to access the YouTube audience, such as:

Buying YouTube ads via Google’s exchange

Buying ads via YouTube Select, Google’s premium, TV-like offering

Cutting influencer deals directly

Working with firms that represent groups of influencers

Working with specialists YouTube buying firms such as Zefr and Pixability

And so on

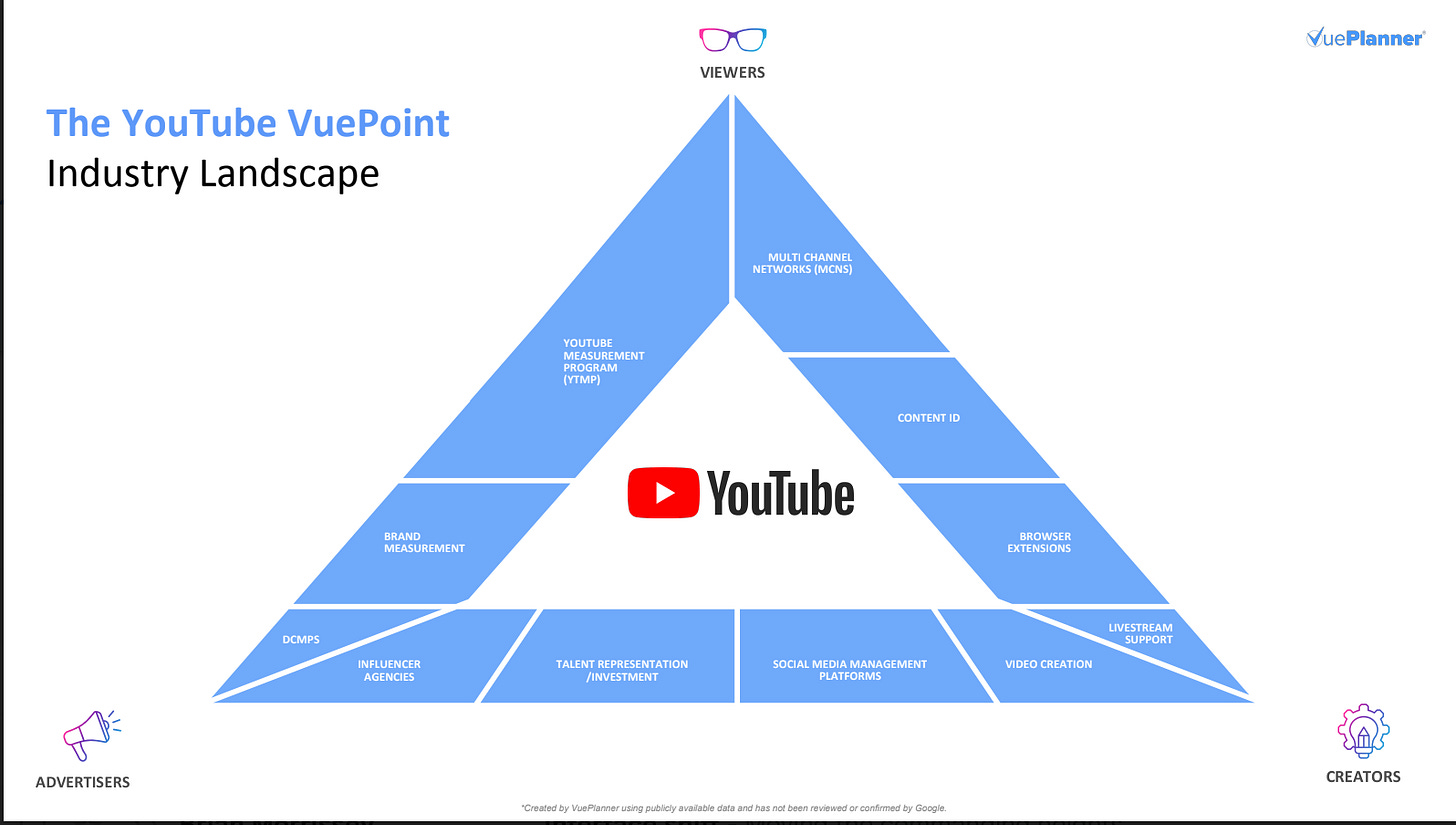

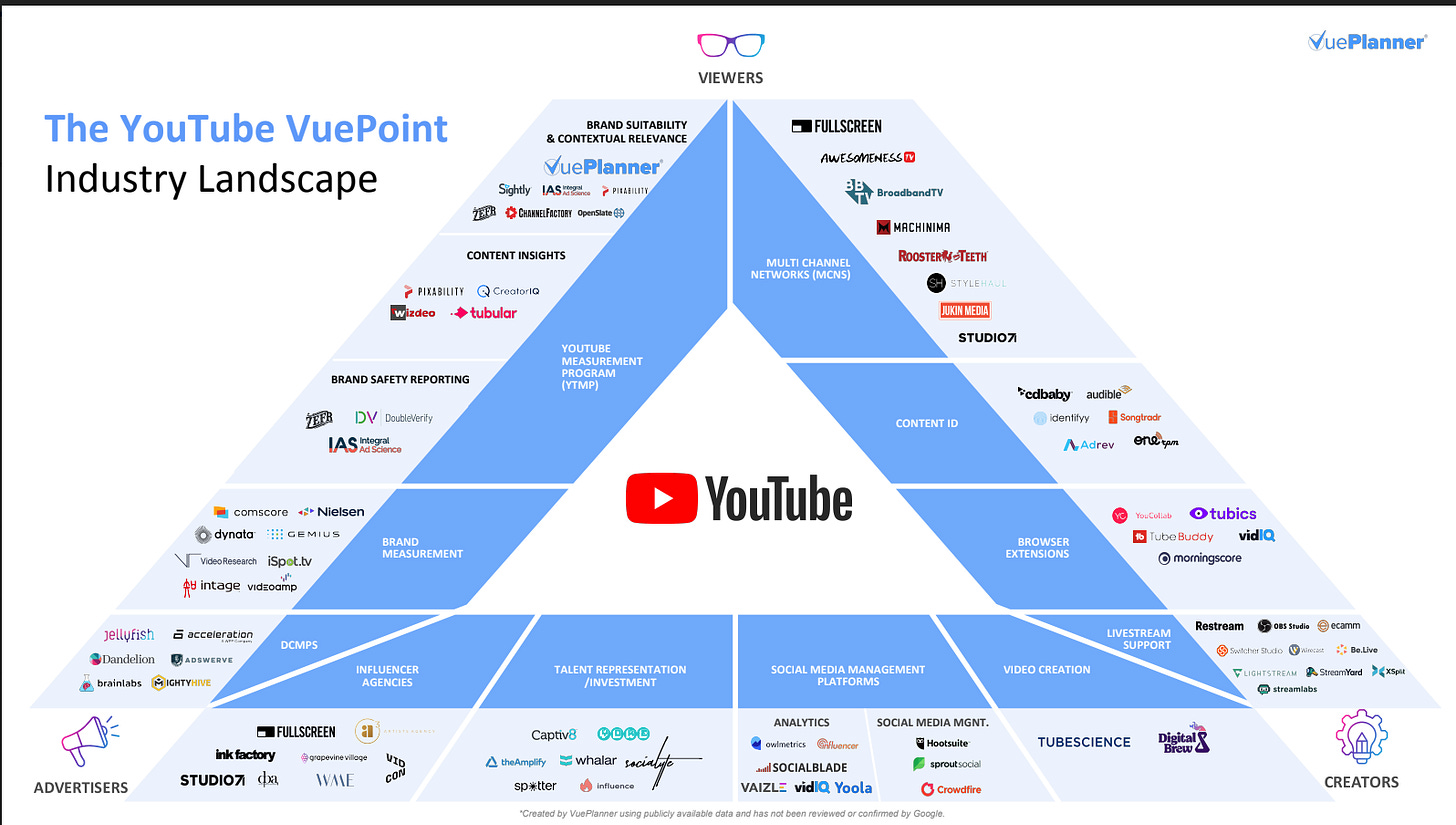

Scott Schiller, head of S350 Media Advisors, who is currently consulting for VuePlanner, has put together a set of Lumascape-inspired visuals for YouTube ad ecosystem, which increasingly rivals any ad tech sector in its sheer complexity.

As you can see (in these charts), there is much to navigate here, including multiple cottage industries- in front and behind the camera - centered around YouTube analytics, talent representation, metrics, etc.

“There is a lot of confusion out there,” said Schiller. “We’re trying to find ways to help brands sort through all of this. It isn’t easy, and this clutter potentially can result in missed opportunities to reach your audience where they are most receptive to brand messages.”

For its part, YouTube’s sales team says it is simply providing a wide range of entry points for brands of every stripe. In other words, options are a good thing. "Today, people’s viewing habits may be complex, but reaching them on YouTube isn’t,” said Brian Albert, Managing Director, US Video, Google and YouTube. “From YouTube Select to ourAI-powered campaign types, we've made it easier for brands and agencies to run the right ad format mix across all types of video - from long-form, short-form, to audio and live - to hit their marketing goals from awareness to sales."

Indeed, on the surface, YouTube is doing just fine. In almost every scenario listed above, (other than brands going directly to YouTube creators to produce branded videos) YouTube gets paid one way or another. It’s not really YouTube’s problem if brands don’t know what to make of one vendor or another. Or is it?

Wendy Aldrich VP, Global Integrated Media Strategy at Pfizer, said her team often struggles to understand how all the companies that plug into the YouTube ecosystem are uniquely different. “There are so many ways in” she said. “Working directly with Google is table stakes. When it comes to outside vendors, sometimes it feels like they all do somewhat similar things. You have to figure out if the juice is worth the squeeze.”

In fact, she’s considering adding a specialist to her team just to focus on video.

Of course, there are other factors at play as to how ad dollars do and don’t flow to YouTube besides the proliferation of outside vendors. A big one remains agency structures, said several industry observers. As much as agencies and brands preach being ‘video-centric’' - many have TV buyers, and social video buyers and digital buyers and even influencer specialists - all of which could interface with YouTube.

Each of these groups has different points of view on brand safety and the definition of premium, say insiders - rather than viewing this ecosystem through the prism of how and where young consumers watch video.

One could argue that even with its broad range of possible revenue streams, YouTube still isn’t pulling in ad budgets that are commensurate with its viewership and influence.

For instance, here’s a chart from the metrics firm TVision that was commissioned for VuePlanner which illustrates the sheer volume of ad inventory available on YouTube compared to other CTV players.

“What this shows is that among the various streaming apps that have adopted advertising, the reach opportunity is just much larger on YouTube,” said Stephanie Hadley, director of marketing and communications at TVision.

The opportunity here will likely only grow larger , particularly as linear TV inventory continues to decline and more YouTube consumption shifts to smart TVs. At the same time, next year’s video ad market will be complicated by the Olympics and the Presidential race. And of course, the industry is still grappling with all sorts of measurement changes.

These issues are very navigable, “especially with open minds and open silos,” said Schiller.

The obvious impediment to YouTube capturing even more share is the lack of transparency and the ongoing challenge to prevent advertisers from running in objectionable content. Recent stories about steering buyers to GVP and not YT proper and failing to comply with YT’s stated rules create trust issues.