With TV Seemingly Vulnerable, Suddenly Video Ads Are Everywhere

Video podcasts, cinema, even retail screens vie for upfront dollars

This post is part of a special three-part series on the state of the video advertising sector, produced in partnership with National CineMedia

In the digital media business, there’s long been this refrain: why is there still an upfront? I can’t believe this is still a thing Isn’t this the last year of upfronts?

That is, until your company thinks it has a shot at those TV dollars that come up for grabs each spring. Then suddenly, you get NewFront/Upfront religion. Case in point - several big YouTube creators, the most cutting-edge of media entities, are looking to hold an upfront selling session this year in conjunction with the startup Spotter.

Every media entity wants video money, and those high video prices. And suddenly, everybody has video to sell.

“Every seller knows putting ‘video’ in their inventory source instantly makes it more desirable,” said veteran media buyer Danny Weisman.

Especially with TV going through such a massive audience transition. You know the story. Linear ratings continue to slide. Streaming is surging, but there is less ad inventory to go around. “Cable, linear and satellite are in mass decline all over the world,” said Barry Frey, President and CEO of the global digital out-of-home trade body DPAA. “And there is not a consumer or brand that doesn’t get up and say I love video.”

Not to mention people are doing other things with their former TV-time, like watching as much TikTok as they can before the clock maybe strikes midnight.

Thus, the thinking appears to be - right now, there is a good a chance as ever to peel off some TV budgets, and grow the video ad pie overall.

“The upfront market has been under increasing pressure from alternative video channels for years,” said Ashley Silver, Group Director, Crossmedia.

The question is whether just having video is enough to make the case for buyers and brands. To me, there are four ‘sectors’ that would seem to have a shot at this:

Video Podcasting (ther are huge audiences for this ‘alternative media’)

Cinema Advertising (aka ads at the movies)

Digital Out-of-Home (more and more, billboards are out, screens are in)

In-Store Video Networks (more screens where you shop_

So I’ve tried to break down just how this might work in ever evolving video ad marketplace…

Video podcasting-

Podcasting of course is not new. The medium has nurtured a solid, if not massive, ad market for several years. Last year, brands spent roughly $2 billion on podcast ads - which is not bad, but is not reflective of the massive audiences many podcasters are garnering, particularly on YouTube. (Google says 1 billion people watch podcasts on YouTube).

That’s because podcasting has generally been viewed as an audio medium by brands, and is often funded by what was once ‘radio money.’

Yet given the attention that video podcasting has gotten post 2024 election, the medium would seem to be well poised to pounce on video dollars - giants like Joe Rogan could surely hold their own upfronts and clean up.

However, therein lies the rub. Is video podcasting going to be funded by ‘video money,’ YouTube money,’ ‘creator money,’ ‘Spotify money’ or something else?

“A lot of people don’t know how to buy that inventory today,” said Weisman. “And brands are sometimes disappointed in buying podcasting programmatically.”

According to George Karalexis, co-founder and CEO of Ten2 Media, which specializes in helping artists master YouTube, this challenge screams for a premium video podcaster networks. “How do brands tap into a network of video podcasters in a way that goes beyond just slapping programmatic ads on their content?” he asked

‘There’s a gap between traditional YouTube creator budgets and podcast sponsorships.”

To remedy that, Karalexis said he’s seeing some brands opt for direct partnerships with top podcasters to lock in sponsored segments, or even hybrid buys that include g traditional YouTube ad spend with host-read sponsorships “to get both reach and credibility.”

Silver, for her part, think video podcasting can play in the big video space. “This is emerging as another major competitor for TV ad budgets,” she said. “Video podcasts often deliver better engagement and ad recall than traditional TV…particularly in key audience demographics like Gen Z and Millennials.”

2)Movie ads

The top cinema advertising companies have hosted upfront presentations for several years. The difference is that today, their hope is to be viewed as a TV replacement vehicle, rather than a ‘special’ platform for experimental budgets or stunt-driven creative.

According to Silver, many brands still view cinema advertising as “niche,” while Weisman noted that the medium has a reputation for charging some of the highest rates in the business.

Catherine Sullivan was a long time Omnicom executive, before being named President, Sales, Marketing & Partnerships with National CineMedia last May. She said she’s been working to address such concerns head on, while looking to take advantage of shifting video consumption habits.

“There is tremendous frustration among brands and buyers when it comes to premium video in terms of what people’s expectation are and what the audience actually is in streaming,” she said.

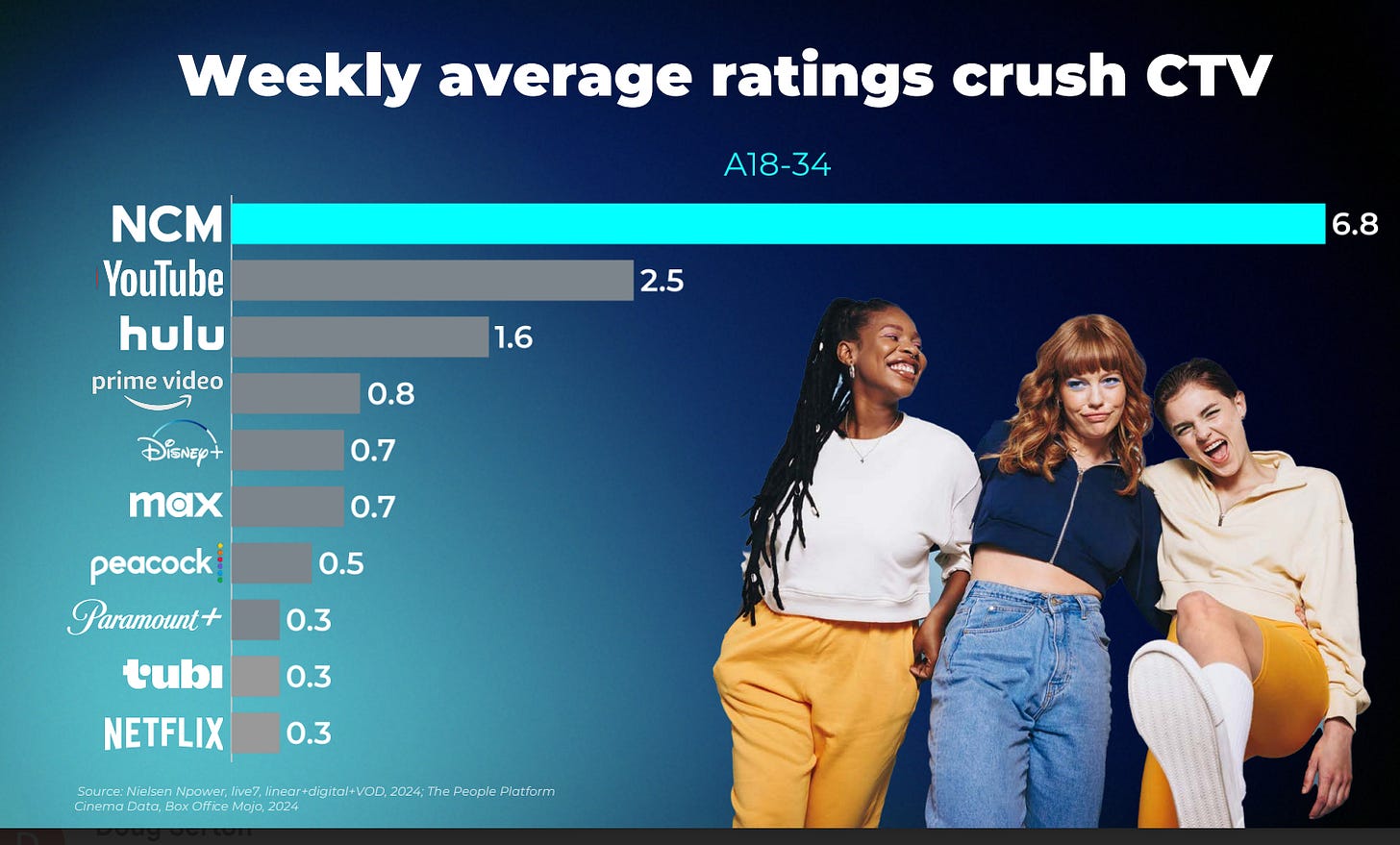

Her take: the inventory pool for streaming advertising is still small, and the audience is older than you think. In fact, NCM has tapped Nielsen for custom research that shows the movies are younger and more diverse than the tube.

“We are 62% multicultural,” she said.

Sullivan also moved to right-size pricing over the past several months to assuage buyer concerns. Her biggest battle to date is trying to push agencies to recategorize cinema advertising (and to get out of the ‘out of home’ category). When starting in her new role, Sullivan immediately went to her old colleagues at Omnicom to work to get NCM’s audience data integrated into their planning tools, and then pushed for the same kinds of integrations at Horizon Media and Publicis. “We are finally in the right bucket,” she said. “We are about incremental scale.”

Not everybody is there yet. It doesn’t help that movie attendance took a huge hit during Covid. “While OOH and Cinema have their own growth trajectories, I don’t see them significantly disrupting the upfront market,” said Silver. “Although cinema advertising is recovering post-pandemic, it remains a niche play with limited scale.”

Sullivan begs to differ. While “first quarter was soft, the year box is projected to be up 10% this year. We’ve got Superman, a new Jurassic Park, a lot of big tentpoles along the way.”

3)Digital Out-of-Home

Old-fashioned billboards and signage have come a long way in the past decade. The industry is far more digital and programmatic than it was just a few years ago -and in fact it’s one of the few media aside from digital that has demonstrated consistent growth; eMarketer pegs OOH spend is forecasted to land a $10.48 billion by 2028 - climbing 3% to 4.8% annually.

“Our medium has a lot of advantages,” said Frey. “You can’t skip the ads. And you can reach people in three distinct areas: their daily journey, their path of purchase, and the point of purchase.”

Frey said that similar to the cinema category, out-of-home has been angling to break out of the ‘other’ label. He points to the fact that GroupM absorbed its outdoor specialty division Kinetic within its core investment group in 2023 as a sign of progress.

“Now it’s strategically and tactically integrated,” he said. “With more video choices out there, you don’t want walls up.”

While that’s promising, out-of-home likely has a perception hill to climb; it’s video for sure, but it’s far from lean back entertainment.

“I judge media plans by reach, attention, and cost,” said Weisman. “For example, if you start comparing Bar Media to TV, what’s where you get into trouble. Views are not all the same, and scrutiny should be place on viewing, environment.”

In-store video

This might be the wild card in the equation. More and more major retailers are installing screens in their stores. Adweek reported last year that Walmart is looking to pump out ads on TV screens in stores, featuring non-endemic brands. The Big Box retailer says that “255 million customers and members visit our more than 10,500 stores and numerous e-commerce websites in 19 countries.”

So theoretically, a Walmart could generate the kind of big reach in short bursts - that the TV networks of olds long have. Couple that with the overall explosion in retail media, and you may be onto something.

“Walmart’s expansion into connected in-store screens and digital shelf ads gives brands a direct-to-consumer video experience that can compete with TV,” said Silver. “Advertisers are increasingly shifting budgets from traditional TV to these channels, where ROI is more measurable.”

That may be the catch. The Walmarts and Targets of the world could tell a great story about TV-like reach and branding - but right now, they are stuck - for better or worse - in the retail media budget. It’s going to be hard to push for TV upfront spending when so many brands associate you as the ultimate performance ad vehicle.

In the meantime, enjoy the upfronts and NewFronts everyone. They’ll be back again, at least for this year.