Why Amazon Should Buy - Wait For It - DirecTV

How to (maybe) jumpstart shoppable TV

I was as good as gone Friday night.

Flying home from a long week on the road, I was eyeing the college football schedule (Notre Dame - Pitt, Alabama - Oklahoma, Texas-Georgia) and realizing that I was going to have to cancel YouTube TV and go back to cable.

Thankfully, by the time I’d landed, the Disney/YouTube battle was over.

While I was thrilled to have things back to normal, that doesn’t mean there aren’t lingering scars. Yes, you can surely argue that there are no innocent parties when two multi-billion dollar conglomerates fight over dollars and jerk around customers, in this case.

YouTube was the one taking away channels I had paid for, and purposefully signed up for that service to watch, not Disney.

YouTube wasn’t just taking away a cable network fighting over carriage fees - it even blocked a broadcast network in ABC. Yes, I realize there are retrans fees involved, and Google was trying to maximize leverage, but still - taking away something that Americans have been able to get free over the air for nearly 80 years felt particularly bogus. And no, you can get an antenna, I’m good.

For the first time I can think of, YouTube came off as the bad guy among consumers. It will be interesting to see whether that has any long term impact. Being a cable company has never been for the meek.

That was a long digression - but in spite of this Disney/carriage war I’d been thinking about YouTube TV’s under-the-radar, emerging advantage in the marketplace when it comes to shopping - ironically after having attended Amazon’s unBoxed event in Nashville last week.

At the show, a multitude of Amazon executives pushed the company’s claimed ability to deliver ‘full-funnel’ ad campaigns for brands of all sizes and goals - but clearly the e-commerce titan’s massive advantage is its ability to drive and track transactions directly from its ads. Drink if you hear the term ROAS at unBoxed next year, and you won’t make it home.

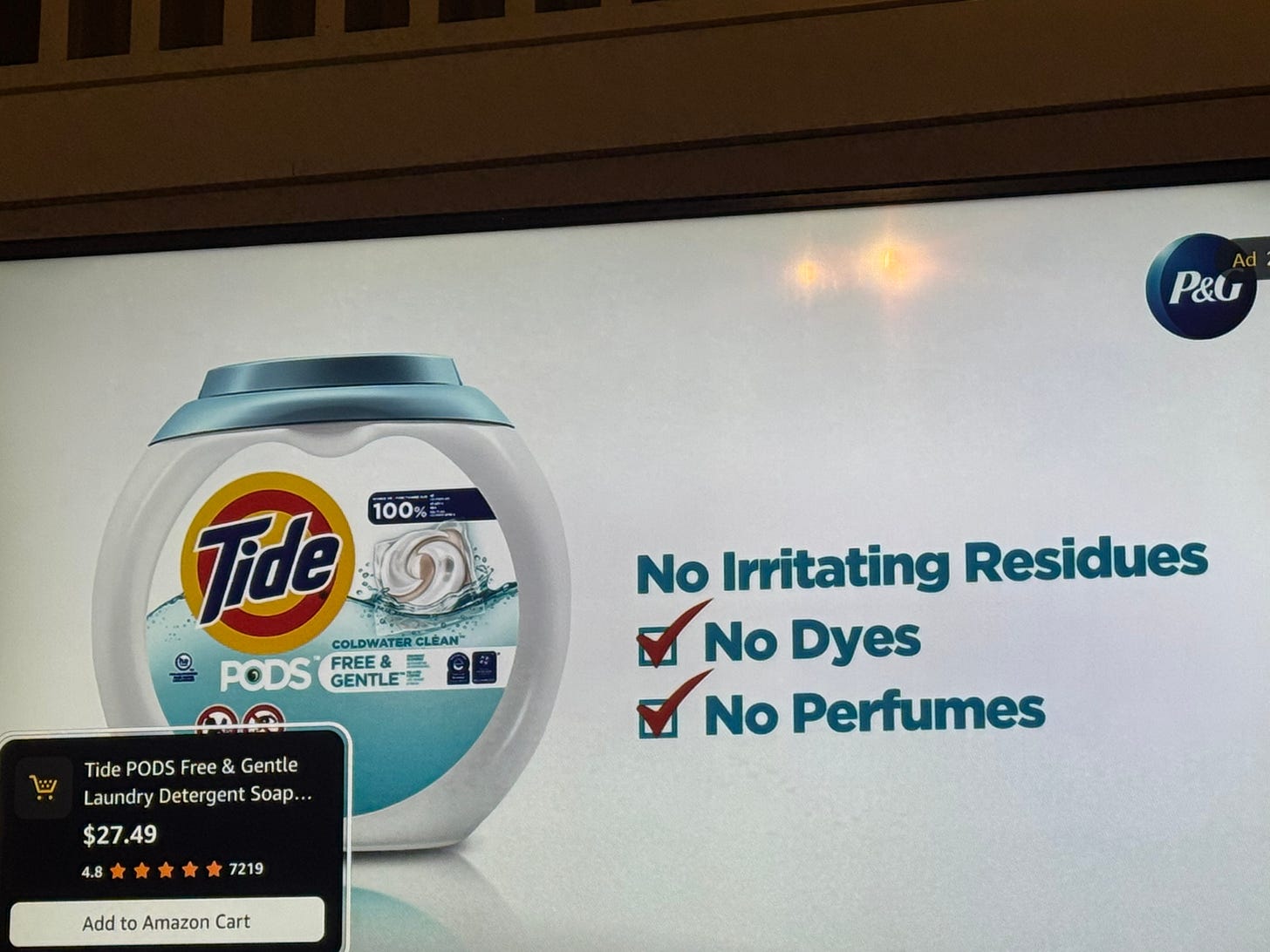

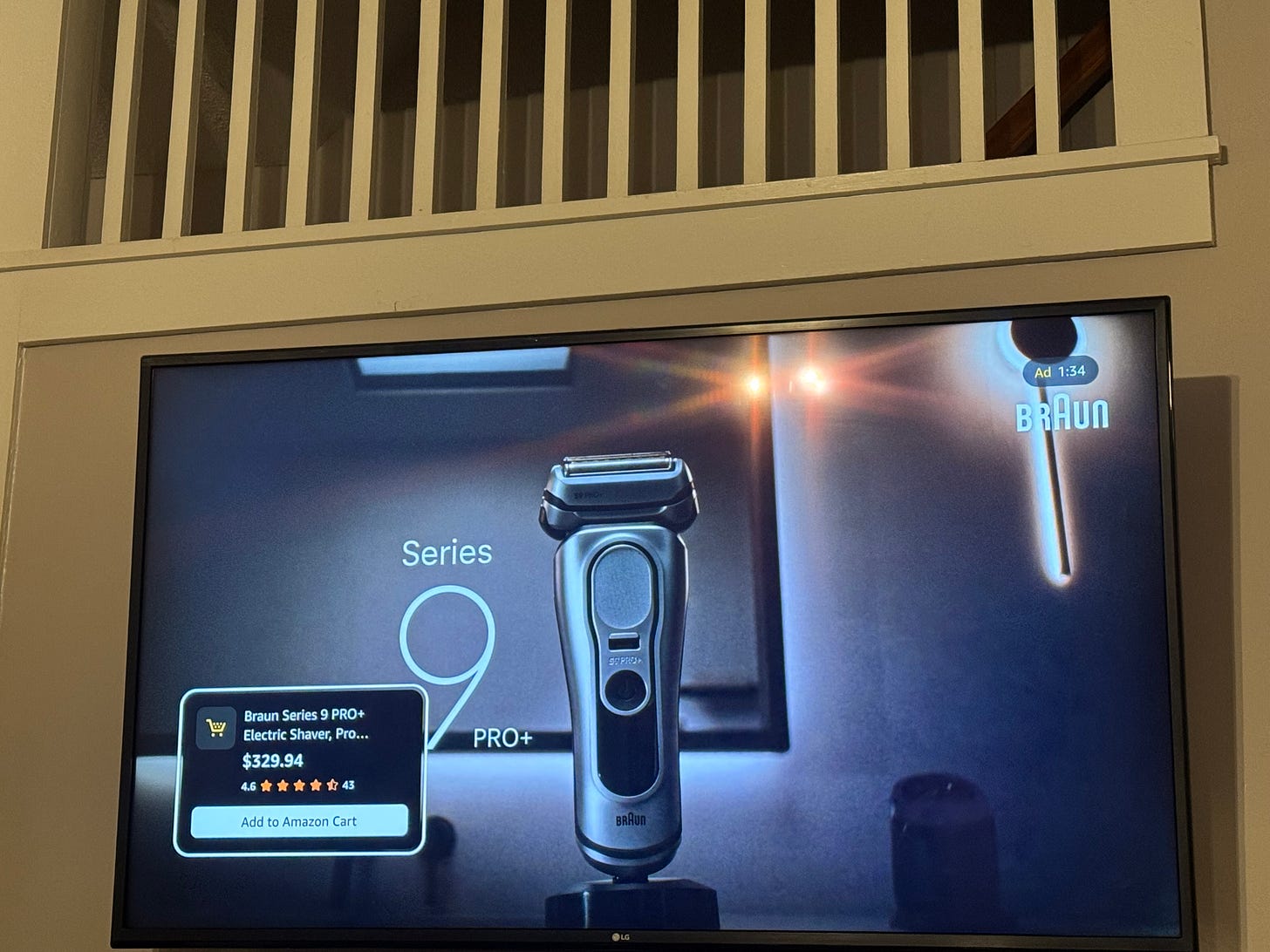

As part of that, it seems clear that Amazon wants to prove that TV advertising can be more performant - one presenter even questioned whether TV buyers are too hung up on measuring old-fashioned audience deliveries. And if you watch any Amazon content, you see many prompts to add items to your cart instantly. This sort of seamless mechanism is likely the only way that TV shopping is ever going to work (by the way, I’m not sure that it will).

Amazon also has a monster, seemingly-shopping-ready footprint with Fire TV, of which there are 300 million devices in the market worldwide. After all, didn’t Walmart buy Vizio for that very reason - to leverage its data to bring better ads to the Vizio operating system?

I recorded a podcast at unBoxed with Charlotte Maines, Director, Devices Content & Advertising at Amazon on this very subject - and her vision for maybe leveraging both Fire TV and Alexa+ for advertising.

“We’re really able to deliver and oversee the customer experience from the moment they but their device and certainly from the moment they turn it on and are, looking for content they want to enjoy,” Maines said. “We’ve sold 300 million fire TVs globally. That is a lot of valuable Amazon customers who are logged into their devices that brands can talk to.”

“And when I think about the advantage that that offers for advertisers and for Amazon overall, in terms of our full-funnel story and the results that we’re able to deliver is… just by owning the customer experience, we are able to ensure that we are driving the CX that delivers great outcomes for advertisers.”

Ok, how powerful is the actual TV interface for shopping (when you are basically trying to find a show, not a sweater) versus actual shoppable TV ads?

For shoppable TV commercials to truly scale, you need lots of real estate - which to be sure, Amazon has plenty of. Between live NFL and NBA games, to dozens of Prime Video shows - Amazon has a growing pile of CTV ad inventory to light up. However, there may be an easier way to ratchet up TV commerce much more quickly - and for Amazon to play a huge role.

Which brings me back to YouTube TV (took you long enough Mike).

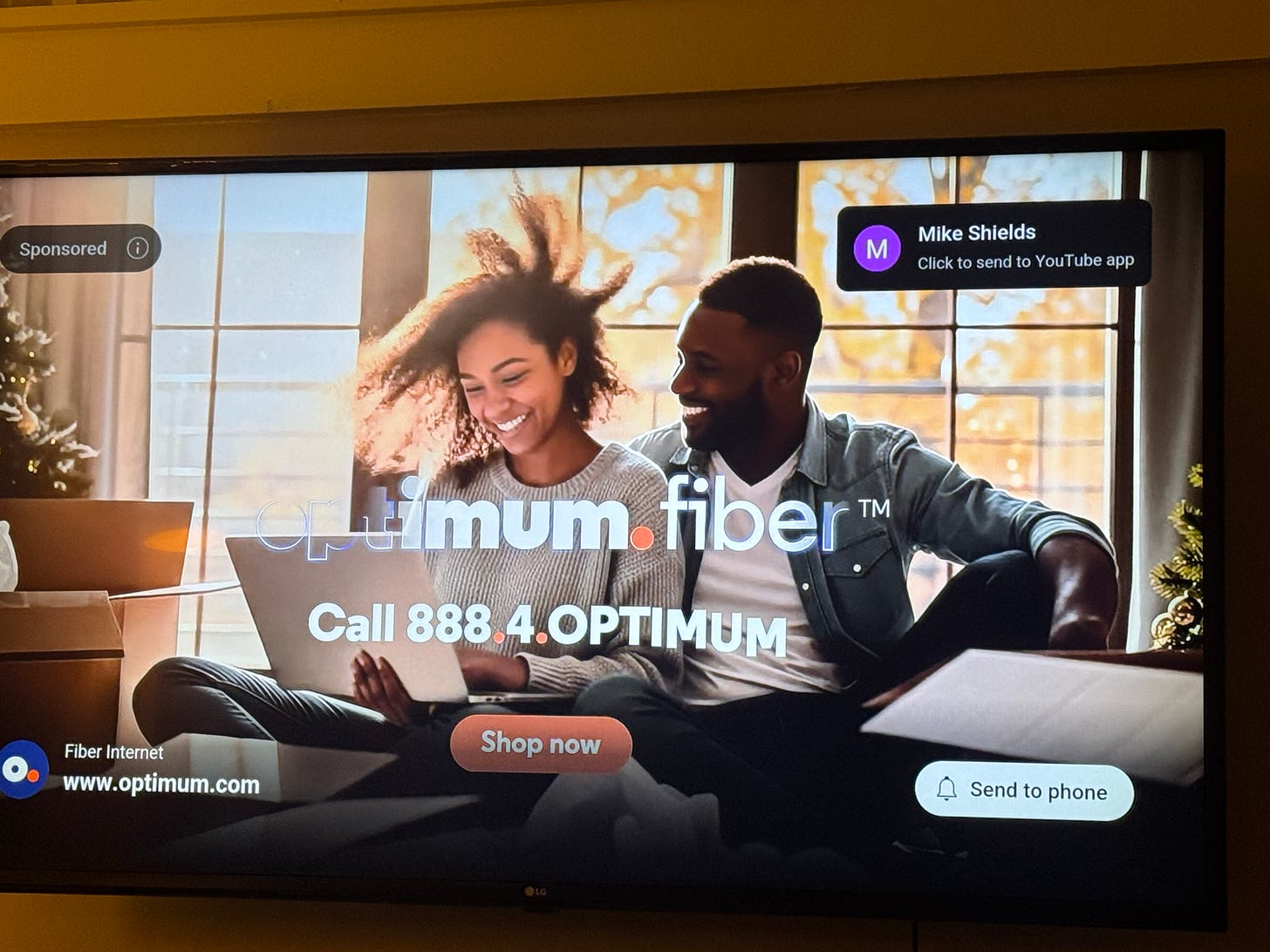

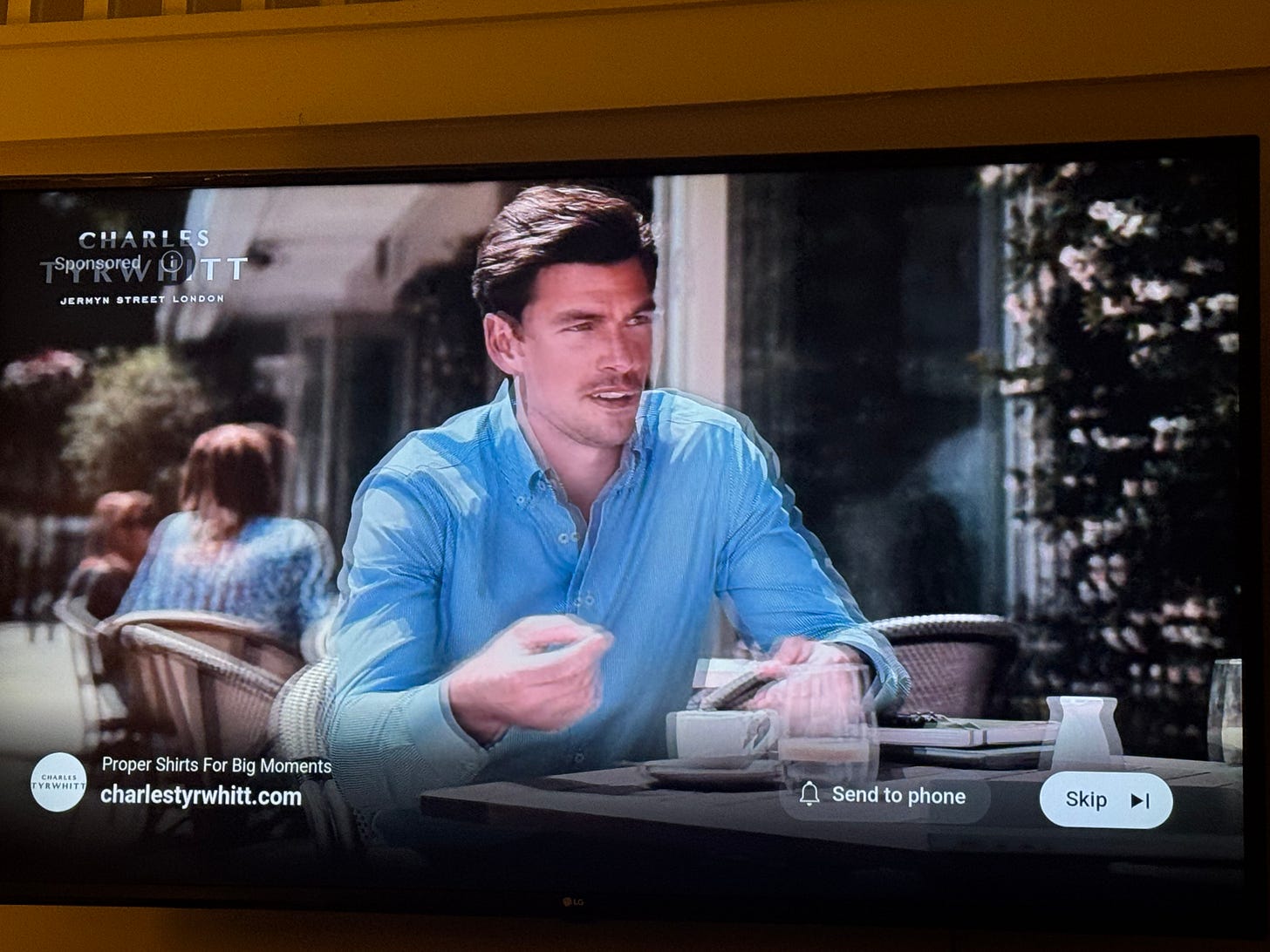

Once you have YouTube TV for a while, you start to notice how often regular TV ads (not special made-for-shopping ones) feature prompts to add items to your phone, or to check out XYZ. These are the result of a new product YouTube rolled out back in June, which lets brands push out an interactive shopping feed.

What’s not clear to me is whether YouTube can only do this for the two minutes of ad time it controls each hour as a cable provider, or for any old TV ad that runs on the networks it distributes. Regardless, YouTube gently make these ads potentially interactive and shoppable. Given how much live linear TV inventory is still available - particularly via sports - this would seem to be a much easier way to push shoppable ads - and make them more visible, and normal, for the average TV viewer.

So to me, the overarching question appears to be: if you want to be the company that drives - and maybe controls - TV shopping - what kind of access is more potent and crucial?

Controlling TV apps (yes)

Controlling the TV OS (debatable)

Controlling the actual TV viewing interface (yes?)

Amazon really doesn’t have a play for number 3. So here’s a crazy idea:

Buy DirecTV

Take the DirecTV streaming service, and Amazon-ify all the ads

While I didn’t bounce this exact question off of Maines, she did speak about the potential advantage Amazon might have in driving people from TV ads to purchases.

“With the products that we have live today around shopping on Alexa and Fire TV, they’re very much voice-first,” she said. “And so anything that you could do on an Alexa device, you can do on a Fire TV, maybe you need to activate your remote with [your voice], but we are not limiting it to requiring remotes to click around to do shopping engagement behaviors. We have the ability for you to add to cart or purchase directly from the TV. But I think at the same time, we also recognize that being able to shop on your phone is very powerful.”

The how of shoppable TV ads is still very much up in the air. Which is why a big company like Amazon pushing a consistent format and mechanism seems key. Owning a streaming service like DirecTV would help - and Amazon could market its streaming service as well as anyone.

However, so there are some challenges with my theory:

DirecTV was just sold to the private equity firm TPG. Usually those PE guys like to take some time to strip things down before flipping their assets

DirecTV has a network of not-growing satellites, which is probably not a business that Amazon wants to be in on long term

Becoming a cable distributor does carry with it some headaches (ask YouTube.)

However, this could help scale shoppable TV via Amazon far more quickly, either via Alexa or the Amazon mobile app.

Plus, as a side benefit, Amazon could lock out rival The Trade Desk, which has explored partnering with DirecTV.

Perhaps a deal could be struck where Amazon simply takes over DirecTV’s user interface and ad sales, and cuts TPG a check. It feels worth a conversation at least.

Again, I have my doubts over whether shoppable TV is every going to work. This may just be a more passive medium by nature. A few weeks ago at Marketecture Live, James Burrow, vp of Universal Ads, said that “none of these clickable TV ads work.” Remember, this is a person who works for Comcast, which owns NBCUniversal - which has been actively testing shoppable TV ads. So that may be a bad sign.

Still, if shoppable is going to happen, of the big players may need to push it at scale to lots of consumers at once - not just a test here and there. Who better to do so than Amazon?

Just debated this with my wife while watching prime... I’d def would click and buy for the right product.. which seems like a needle in the haystack issue. Her, never..