Meta is bleeding. Amazon is hungry.

Can the king of retail media go broader, and capture all those Instagram advertisers ?

Retail media is projected to be a $100 billion category this year. Amazon, the category’s clear king, sees that figure as a decent place to start - like ruling a nice little island kingdom.

The once reluctant ad player appears to have its eye on so much more than ‘shopping ads’ - it just wants the whole realm.

(Ironically Apple, ever the sea snake, may have opened the door to such a conquest).

Amazon hosted UnBoxed this past week at the Javits Center in New York. After starting as a smallish gathering in Seattle a few years ago, followed by back to back virtual events during Covid, this was the first time that Amazon put on a full scale ad-focused event like this of its own. Let’s just say, they went big - two full days of panels, open bar, dumpling stations, influencers filming shopping videos, etc. How competitive does Amazon want to be in this splashy industry? The company literally rented The Killers for an exclusive concert Wednesday night.

The message was clear- maybe we were simply dabbling in advertising at one point. But now we’re here -and we have dragons.

(I realize these metaphors should be about elves and rings, but I don’t watch that show).

It was hard not to view this show of force in the context of what else was going on this week - namely the Big Tech Earnings Meltdown Part Two. Following Snap’s scary miss, Google reported that YouTube ad revenue was down for the first time. And then there was Meta, which not only saw revenue decline again, but profits tanked.

Enter Amazon?

That was the question I had as I bounced around the event, which was part ad conference, part trade show, and part Amazon’s version of the Democratic National Convention. If you think about it, even as Amazon became a $30 billion ad juggernaut last year, to date most of the company’s ads products have been the digital equivalent of coupons for Tide right at eye level in the housewares aisle at Walmart, or the pack of gum and US weekly at the counter. There isn’t a lot of storytelling going on, as these ads couldn’t be more down the funnel.

To some, Amazon’s ads aren’t about trying to drive more business, but are simply the price of doing business. One paper goods seller I spoke to at the show said he spends $20,000 a month on Amazon ads - not so much because they work (they do) but because if you don’t advertise, you barely exist on site.

You might even ask - is this really advertising, in the traditional marketing sense?

Well, at unBoxed, Amazon spent a great deal of time talking about anything but pure ‘retail media.’ During a keynote address on Wednesday, Colleen Aubrey, Amazon’s Senior Vice President, Advertising Products and Tech, repeatedly mentioned words like “discovery” and “delight.”

“For years..we’ve come back to this question: ‘How does a brand develop a relationship with a customer?’” she said. It didn’t feel like a very Amazony question.

To that point, Sam Cox, who runs Amazon’s DSP, didn’t talk about using first party data to nab shoppers, but focused rather on how Amazon’s “hundreds of millions signals can be used to reach people who not necessarily in shopping mode. And they don’t need cookies or mobile device identifiers to do so (like say, Meta).

“Precision and accuracy are not one in the same,” he said. “We have an opportunity to improve on the tools marketers use to create connections and tell relevant stories to consumers…. by predicting in-the-moment interests without sacrificing relevancy, privacy or performance.”

In fact, Amazon is rolling out a new contextual ad offering, as well as a slew of other products designed to help reach much broader groups, such as roughly 40 million athleisure enthusiasts the company has identified.

“We can uniquely predict how content and context pair with intent,” Cox added. “We are excited about the future of relevancy in the changing digital landscape…we are leaning in to the headwinds and raising the bar along the way.”

Translation - that whole Apple thing hasn’t hurt us, and we now want the whole funnel.

My question is - Meta is clearly wounded, thanks to Apple kneecapping attribution -can Amazon steal all those ATT dollars? The magic of hanging out on Instagram and suddenly finding yourself seeing lovely, magaziney ads for loveseats that you’ve kinda been thinking about buying, and now you’re seeing ads from these indy DTCs you’ve never heard of and suddenly you’re typing in your credit card…those days feel over.

The brutal economics of DTC brands on social platforms has been well chronicled. So I’m wondering, could those advertisers be served by Amazon, with all these amazing signals?

As one agency attendee put it to me: “That Facebook pixel was everything but it’s gone. Amazon doesn’t have to worry about that. It’s their data, their properties.”

Between Prime and Twitch and IMDB and Amazon.com, this person explained, the company has tons of aggregate data on what consumers like and want. “They are the next great intent leader.”

True. But it seems to me that Amazon’s ad base is very different from that of Instagram and Facebook’s. And Amazon doesn’t have a social platform where you just hang and browse - the core Amazon.com property is so utility -and its ads largely reflect that.

So if they want to get into the demand-generation, data-driven serendipity business, it’s going to have to happen, as Cox put it, “off Amazon.” That seemed to be the company’s focus.

“We think we can uniquely predict how content commerce and intent pair,” he said. “We are excited about the future of relevancy.”

In English, this means they want to be able tell people about new products, while moving down the funnel as seamlessly as possible (something even Instagram couldn’t do). To that end, Amazon showed off a slew of new creative services aimed at ‘immersive storytelling” such as “sponsored display video creative, and even instant TV ads built within Amazon’s Brand Studio.

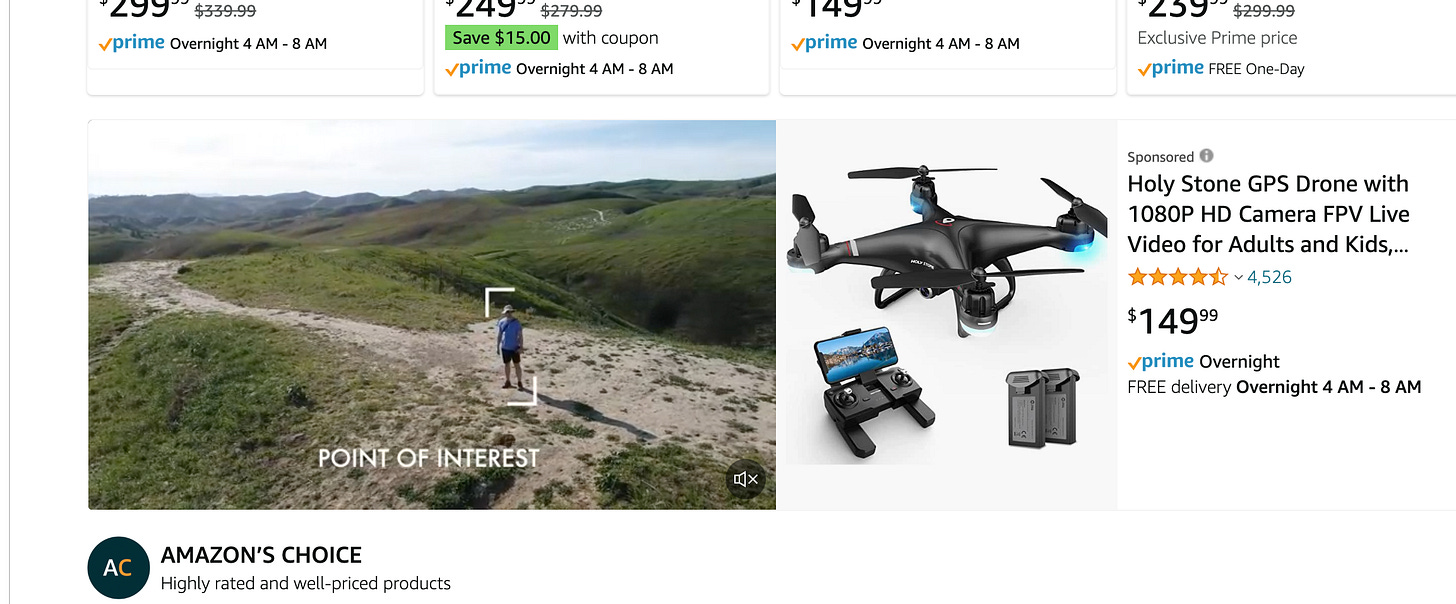

The company showed off work it has produced for Holy Stone, an upstart Drone brand that had never produced TV ads before, and presumably doesn’t have the budget to hire a big creative agencies.

Last year, the brand used Amazon’s tools to make a visually arresting video ad that reached 1 million viewers, and sent searches spiking 279%, according to the company’s executives.

Was this a cherry-picked case study? Yes. It was also an impressive display of the Amazon’s potential.

I realize that Amazon missed on earnings yesterday, which has investors nervous. Guess which segment of its business exceeded expectations.