Is Samsung the next walled garden?

Or is advertising always going to be a side hustle for the South Korean tech giant?

They say it’s good to do something that scares you every so often.

With that in mind, this week I listened to a webinar.

I’m fine, thanks for asking. Truthfully, it was only part of a webinar. And it was actually pretty informative! Samsung executives were talking about how they can use automatic content recognition (ACR) data from their TV sets to deliver ads to specific audiences, including those who might inclined to purchase certain direct to consumer products, even pharmaceutical brands.

“It’s much more granular than what traditional broadcast networks have been able to provide in the past and it’s very quantifiable,” said Allison Sanjuanelo, Senior Sales Manager, Pharma at Samsung Ads. “The most advanced clients now are looking at TV as a whole. It’s not just CTV vs. linear… It’s looking as a whole at the biggest screen in the house.”

It was very ‘this is the real promise of connected TV’ kind of stuff. The sort of thing you might expect from Amazon, or Google, or maybe a TV giant like Disney.

But Samsung? I can’t decide if they are the biggest sleeping giant in advertising, or a company that needs to be much bolder to live up to its potential.

Think about what Samsung has in its portfolio:

It’s the top selling TV manufacturer in the US and the world

It shipped 250 million mobile devices in 2022, accounting for 20% of the global market, per IDC

They have a FAST service, Samsung TV Plus, which generates lots of TV inventory

Samsung also sells ads on its own navigation bar and for some TV apps

They have ACR data (a built in Nielsen or iSpot) which can be used for delivering ads more precisely

"They have two big things going for them - massive distribution with hardware, and they have log ins across tons of devices,” said one industry observer. “The question is can they tap into all this potential."

When it comes to CTV, “They might be furthest ahead in the ecosystem,” said Tim Hanlon, Founder and CEO Founder and CEO.

Hanlon said he works with several FAST services, and consistently, Samsung delivers more streaming volume than other TV manufactures, sometimes by a wide margin. (At the same time, one person I spoke to said that Samsung’s app store had been a laggard before catching up).

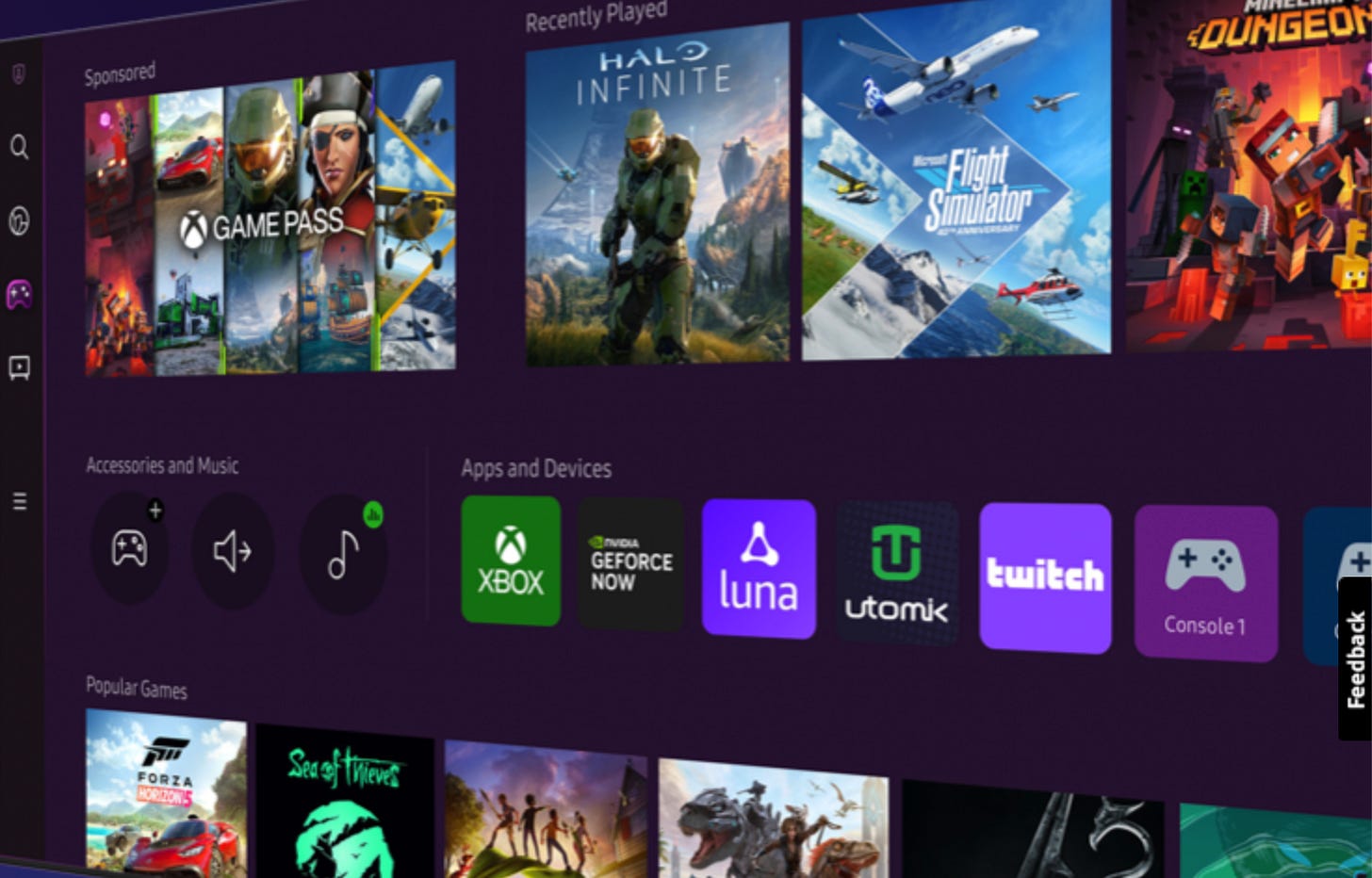

Samsung is even pushing into gaming. The company is trying to succeed where Google and Amazon have largely failed - making cloud gaming a big thing. However, instead of making games or rolling out a subscription service, Samsung’s Gaming Hub features a wide mix of free ad-supported games and for sale titles.

While this gaming hub is not exactly the next PlayStation or Fortnite, Samsung is able to train some people to play games right on their TVs, while using the data they gather on gamer audiences to target them while watching TV.

At the PlayFronts a few weeks ago, Karl Meyer, Head of Samsung Ads, Media and Entertainment, North America told Beet.TV “We’ve built quite a large audience segment of gamers,” he said. Like with cord cutting, over the next few years “the console could go by the wayside.”

Given how hard it is to still land a PS5, that feels like a ways away. In the meantime, the bigger question is, what is Samsung’s end game with advertising? Here are some questions I came across in talking to industry insiders:

Is advertising a major priority for a company that also makes tablets, robots and dishwashers?

There was a time when Amazon didn’t seem to want to play the typical ad game - having a presence at Cannes, doing conferences, lunches, thought leadership. That has changed obviously. Does this interest Samsung? Might Samsung suddenly get serious and go big?

To that point, while Samsung Ads has a huge team (Elad Persky, SVP; Global Product, Engineering & Business Development; Ads & Data, is said to have close to a thousand people reporting to him), it’s very low profile. Who is the face of Samsung ads in the US.?

Maybe the biggest question of all - what about mobile? Samsung sells millions of phones and tablets, seemingly creating a massive footprint through which the company can not only advertise to logged-in users, but also connect what they are doing on mobile and TV. (Who else in the US has the TV and the phone?). But this is where Samsung falls short, say mobile ad veterans.

Is Samsung a true mobile ad player? Not really,” said one insider. Samsung does operates an Android app store where they sell ads but “it's not a scaled channel.”

One way that Samsung can use its mobile reach is to deliver ads on TV to people using mobile data, said a source.

For now, CTV is the area where Samsung seems best set up to win. Its TVs are pricey compare to say a Vizio or TCH, so it can sell advertisers on an even higher-end consumer. Plus, it’s not shy about blending its measurement capabilities with ad sales (who needs third party currency). The Roku/Amazon CTV playbook seems within reach.

Yet Samsung isn’t out there with proprietary ad products like Vizio Inscape. it’s not looking to meld Retail Media and TV like Walmart and Roku. It’s certainly not making original shows…

There’s also the question as to whether it makes sense over the long haul for TV manufacturers to be in the advertising business (Mike ducks). How many brands want to reach just Samsung TV viewers, or just LG homes? The space screams for a roll up. Maybe a winner emerges (like Samsung) and becomes a CTV aggregation giant. In the meantime, it’s fair to ask, why isn’t Samsung mentioned among the walled gardens?

“It’s a bit of a mystery,” said one executive.

Sounds like a great subject for a webinar.

Playing Fortnite on my 65” Samsung, only an xbox controller. Works great....