Despite Some Big Talk, When it Comes to Creators, Top TV Brands Are Still Moving Pretty Slowly

YouTube landscape dominated by challenger brands, DTCs

Nearly everyone in the advertising business is espousing the importance of partnering with creators. And creator deals are surging, particularly on YouTube.

But a closer look at the brands fueling this surge reveals a somewhat-surprising trend - the biggest TV advertisers don’t appear to embracing creator integrations as quickly as you might expect.

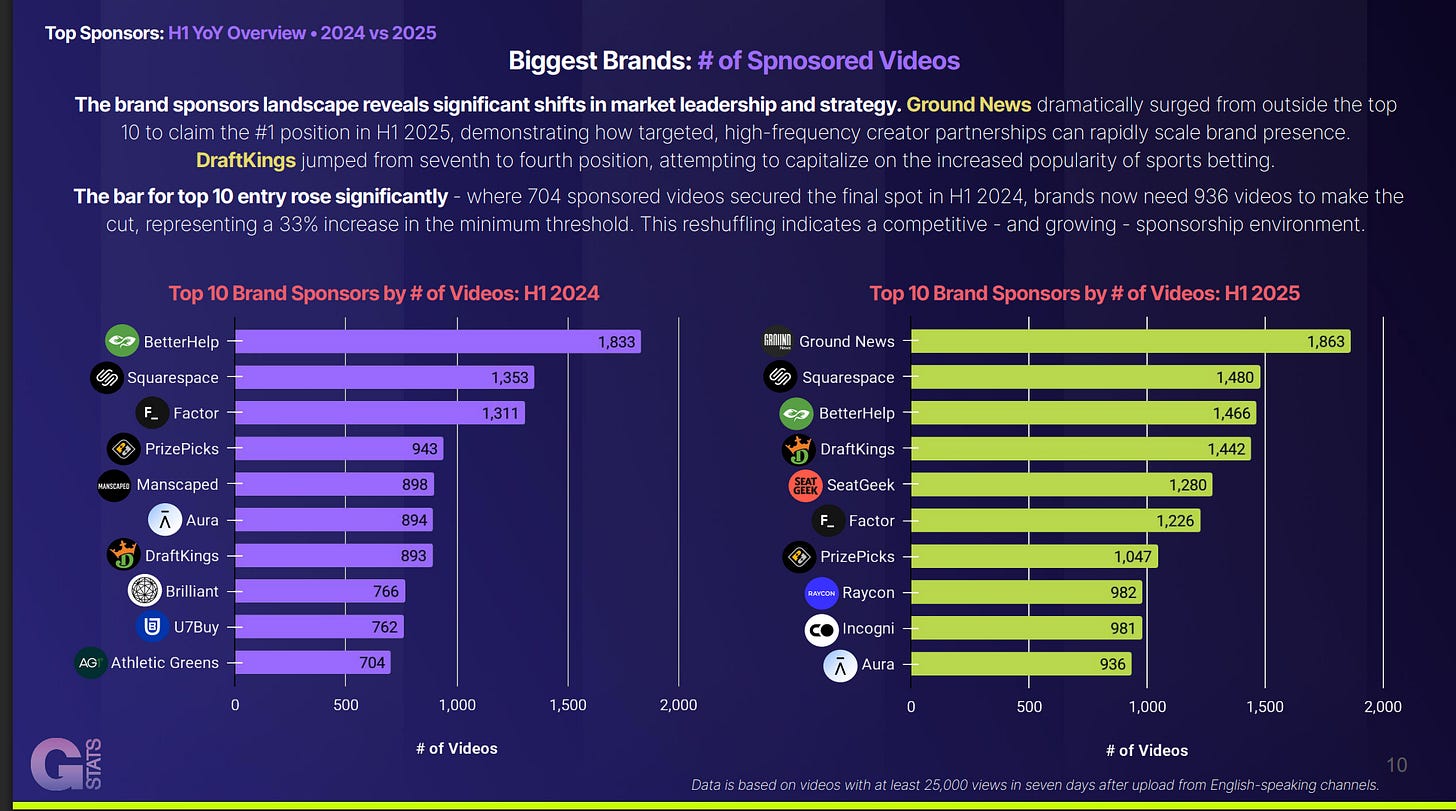

Rather, the top 10 lists of brands inking creator deals are mostly made up of upstart brands and digital centric players such as Manscaped and Athletic Greens, according to new data from Tubefilter.

Maximize your YouTube advertising with VuePlanner. As a member of the YouTube Measurement Program for Brand Suitability and Contextual Targeting, VuePlanner enables you to buy with confidence, clarity, and precision. Using advanced technology and AI-powered optimization, VuePlanner offers custom-curated contextual collections, exclusive content strategies, and transparent reporting for measurable, impactful results. Take control of your campaign performance—partner with VuePlanner now.

Tubefilter released its inaugural Gospel Stats report last week, which showed a not surprisingly but still eye-opening 54% jump in creator sponsorships on YouTube. I had a chance to dig into some of the data with Tubefilter founder and COO Josh Cohen.

What stood out to me was that I expected the top brands running creator sponsorships to be comprised of the biggest-spending brands in the world - the Cokes, the Geicos, the McDonald’s, etc.

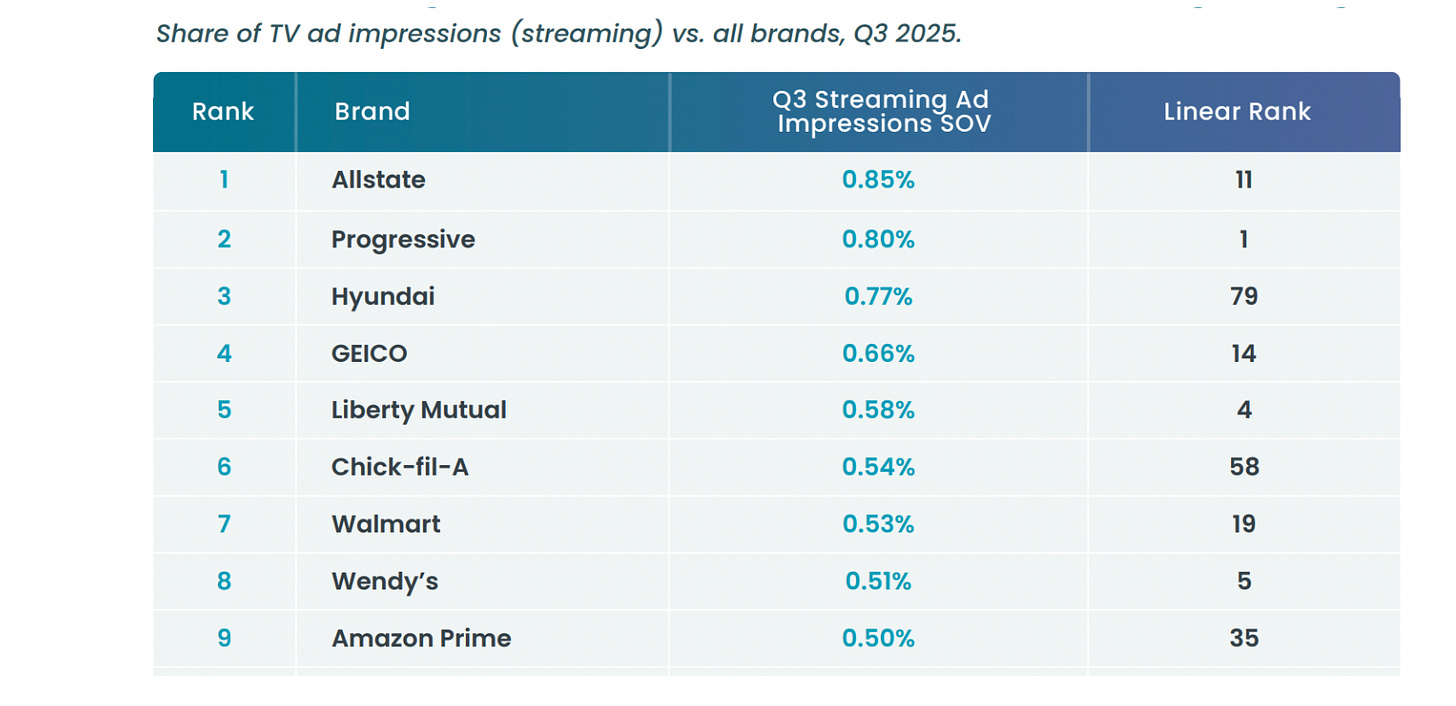

With the exception of heavy TV advertiser (and relatively new brand) Draftkings, it’s a markedly different list than the typical Procter & Gamble or Unilever-dominated charts we’re used to, even as the brands profess that they are all in on creators. Even the top advertisers on streaming platforms is a far more of a traditional ad roster (thanks The Measure/iSpot).

I asked Cohen for his take on this - are the big TV brands just slow to change? Do they not value creators as much as newer brands - since they’re often after mass reach? Or is it just too hard for these advertisers to move big dollars to these digital stars?

“I think it’s a couple of things,” he said. “Until recently, YouTube hadn’t caught on as much for brands as a place for influencers, particularly long-form video inventory.”

Indeed, lots of brands were quick to work with influencers on platforms like Instagram and even Twitter, where it was relatively easy to get a campaign up and running.

“You can write 10 tweets a day, or have your social team knock out an Instagram post. That stuff is very easy to green light,” Cohen said. “With creators, you have to line up your work with their production schedules, brands want to see a rough cut, etc. And many creators on YouTube weren’t ready for that until fairly recently. You’d ask them about their Q4 plans, and they’d say ‘I don’t know what video I’m making tomorrow.’”

To be sure, as Cohen noted, the McDonald’s and Progressives of the world spend lots of cash on YouTube advertising - which may help them feel as though they’ve checked the creator box.

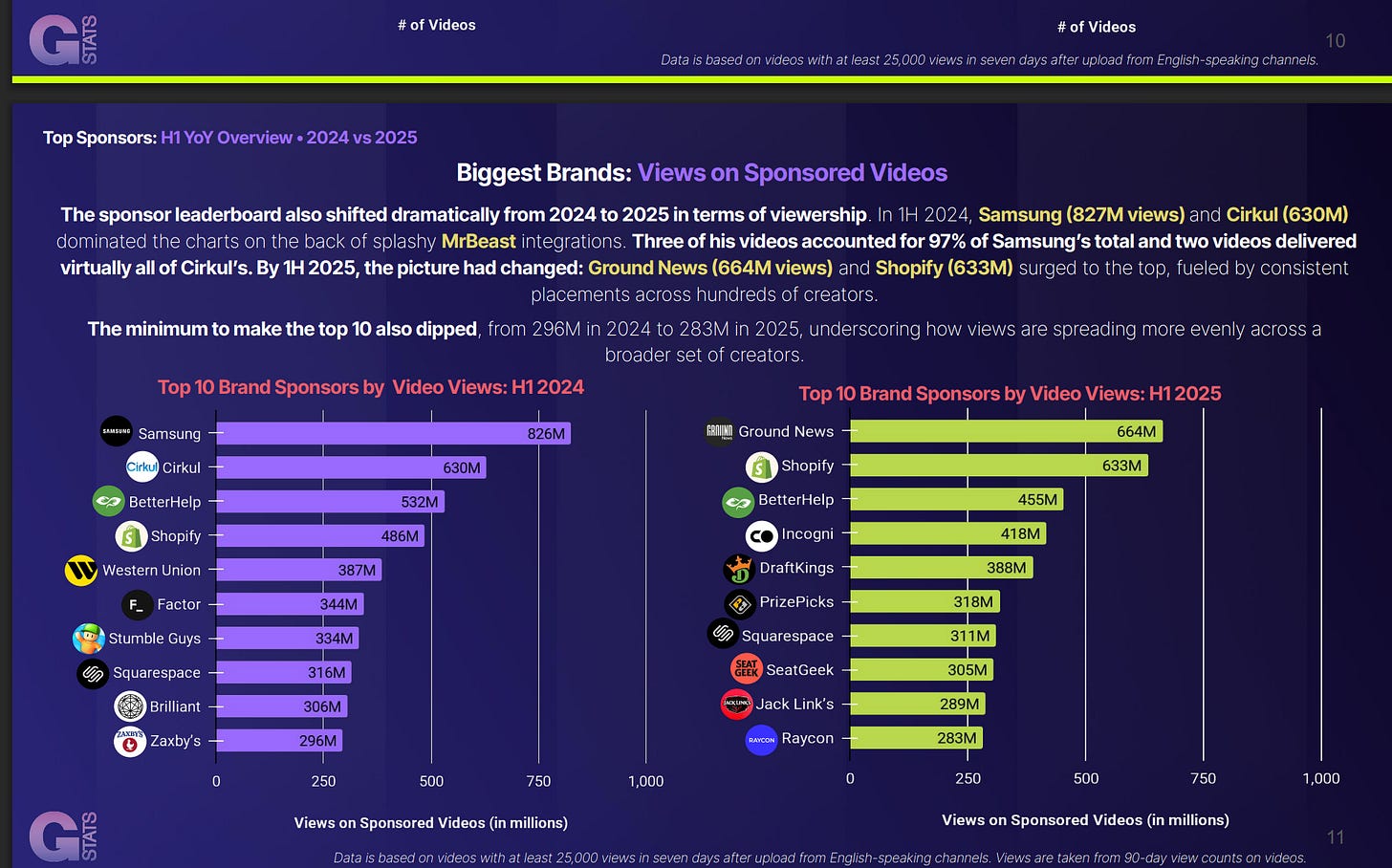

And some brands, like Samsung, are getting a lots of views through creator sponsorships on YouTube. Though they seem to be the exception.

The other factor, Cohen theorized, is that even though YouTube has always been known for its content breadth, it’s only recently that you see the range of creators producing at a high level in more niche areas, like say woodworking.

“There is just way more inventory,” he said. “If you asked the question, how could some of these brands deploy tens of millions of dollars a couple of years ago, they couldn’t do that.”

That seems to be changing, which should theoretically reshape this list over time. My question is, will these big TV brands be able to get the ease of buying and measurement they are accustomed to? The jury’s still way out.

Aside from the brand makeup, one other thing stood out to me from the new Gospel data. The biggest creators - Mr. Beast, Mark Rober, etc. - are seeing their views for sponsored videos decline (when everyone else seems to be going up).

What gives? Did Beast and Rober suddenly get bad at making sponsored videos? Are these types of creators so big that they are just less focused on advertising (because they make chocolate bars, etc.)?

It may just be that as YouTube becomes broader, and more brands get more creator experience - they start to broaden their horizons.

“When any brand has a lot of budget, they’re gonna go for biggest name recognition,” said Cohen. “Then [the longer you’re on YouTube], you do a deeper dive.”

To be sure, Beast and Rober are going to be just fine. And the more that brands expand their YouTube journey, the better for mid level or even ‘micro’ influencers.

The part about Mark Rober and MrBeast seeing declining views on sponsored content is fascinaing. I wonder if it's also about audience expectations. When you're known for such high quality passion projects, maybe viewers start to tune out when they sense a brand integration is coming. It's not that they're making worse content, it's that their audiences are there for the glitter bomb revenge videos or crazy engineering challeges, not product pitches. The broader inventory point makes sense too. Brands are realizing they don't need to pay top dollar for the biggest names when a mid tier creator with a super engaged niche audience might actualy convert better. The whole thing shows how sophisticated this space is getting.

Great timely piece, Mike.... In my view, more balanced/objective than several other recent hop-on-bandwagon articles on this Subject. I originated from CPG-where some are slow to move without measurable PROOF....Others -like P & G prev. went back and fourth on viability of non-traditional ADV tools-with $billions of Ad dollars at stake.