Can TV-Makers Really Grab TV Dollars?

Samsung, LG and Vizio boast massive reach - but is that the same as a TV-like audience?

I have to admit - I didn’t see the TV manufacturers sticking with operating TV ad sales businesses and TV ad tech platforms, for the long haul.

Yet here are Samsung, LG and Vizio (now part of Walmart) going bigger each year, hosting NewFronts and hiring armies of sellers.

My question is, can you really crack that $70 billion TV advertising market, if you’re (mostly) a business built around a home screen where many people are just passing through on the way to watch TV elsewhere?

I get financially why advertising - with its promised high margins - is appealing in a category that is known for thin ones on increasingly thin and cheap TVs. But running an ad business is a slog, and building/maintaining ad tech is not for the faint of heart. Then there’s the content business - where being a programmer means battling giants like Disney, Netflix and YouTube, which spend billions.

This past week, we heard from the Big TV 3, who along with Roku and Amazon, are vying to become dominant TV operating systems in the US - gatekeepers and even tastemakers in television. LG, Samsung and Vizio all talked up their exclusive ad units, their huge audiences, growing FAST services and a handful of exclusive content deals, each designed to help them break through the clutter.

How can they maybe pull this off? Here are a few things to consider:

Yes, those home screens are big

At Vizio’s NewFront, Sean Booker, Head of Media and Entertainment, talked about the company’s “scale on the biggest screen on the home” and “streaming’s most valuable real estate.”

Execs from the company boasted about users spending “31 minutes a day on the home screen” while generating “focused, high-intent engagement.”

Similarly, Samsung’s Travis Howe, Global Vice President, Global Head of New Product Solutions said that his company’s smart TVs are “at the forefront of CTV, and the “Home screen is the most visited real estate across the world’s largest TV footprint.”

Netflix or YouTube might want to argue that point. Though I don’t doubt that the TV home page is becoming akin to the Yahoo or Google of the medium.

It also seemed noteworthy that Vizio’s team focused on the entertainment category, where it makes perfect sense for streamers, networks and movie studios to fight it out for visibility as they try to get people to watch their shows or buy their services and movies.

But for other brands seeking video exposure that is comparable to ads delivered during TV shows and other videos? Well…

They all talked up how big their FASTs are

Vizio’s group VP Katherine Pond said that the company’s Watch Free+ service offered “70% more content this year” including 25,000 on demand movies and shows, along with 300 live channels

Sarah Nelson, head of business development, claimed that Samsung TV Plus reached 88 million global uniques per month, and enjoyed 30% year-over-year growth

Wow right? Sounds massive. But here’s the thing. You won’t find this viewership corroborated bythe leading third-party research services.

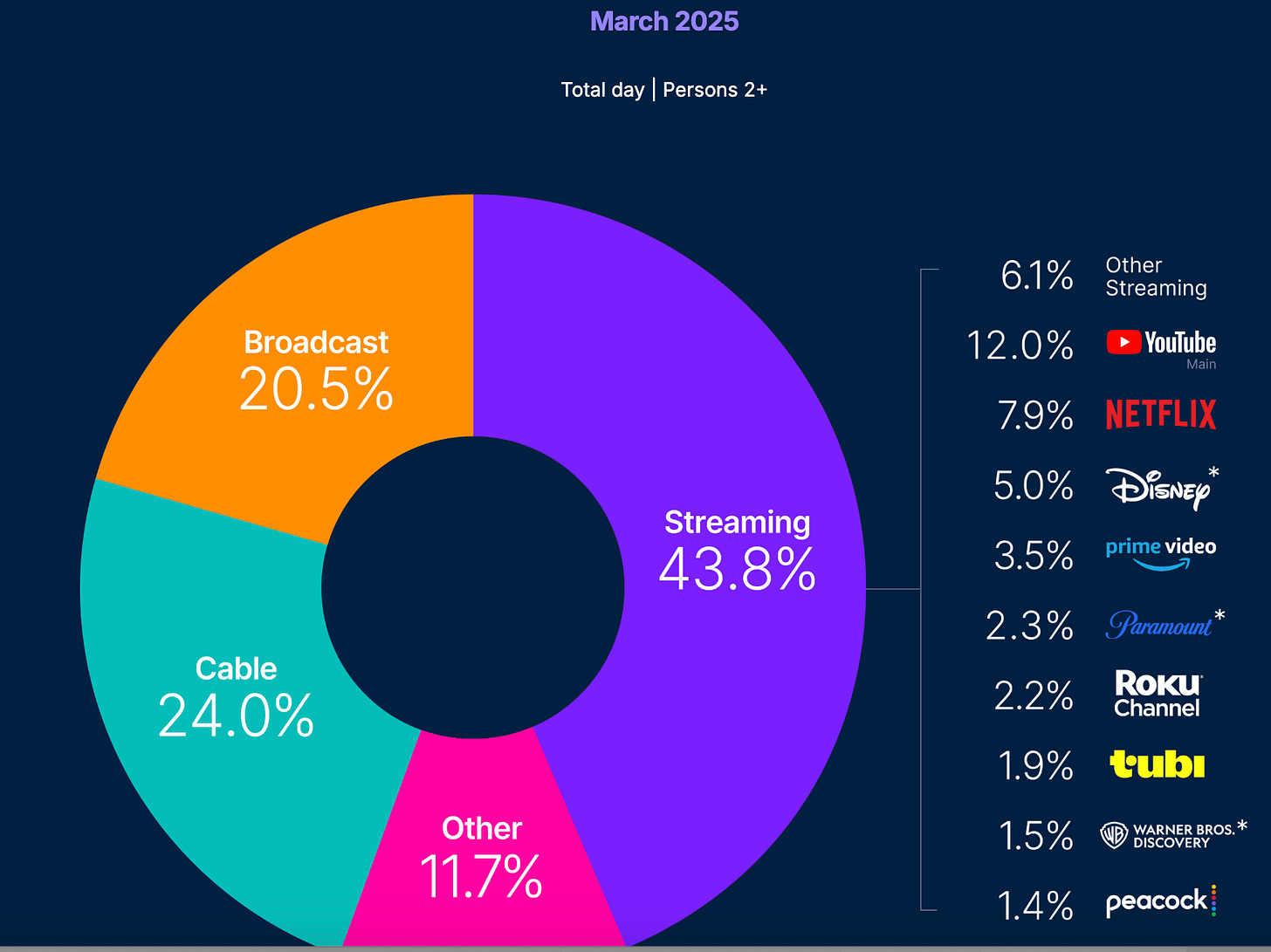

For a streaming platform to be included in Nielsen’s The Gauge, it has to exceed 1.0% of TV viewing. Right now, neither Vizio Watchfree + or Samsung TV Plus are making the cut, despite both companies’ claims of massive growth.

As one buyer told me, these TV makers are '“growing at a fair clip” but will likely be fighting for “second tier” budgets. “I don’t see them making a huge dent in CTV dollars. The major networks are still the big dogs.”

They are doing ‘tentpoles’

Samsung announced an exclusive live concert with the Jonas Brothers.

Vizio - an exclusive presentation of the Billboard Women in Music Awards

LG - a channel curated by 50 Cent

These are all cool - but are single content events enough to move the needle among brands and viewers? I guess you have to start somewhere. This tactic feels reminiscent of Roku over the past few years, going big with a single Weird Al movie and small batch of originals.

Sam Bloom, head of partnerships at PMG, said it actually reminded him of an old Blockbuster Video strategy, of using a few big hit new releases to drive more business overall (he was an exec there back in its heyday).

“I think OEMs are having a moment,” he said. “This is like merchandising the new release wall, only to get more time spent in their FAST channels. It’s not necessarily that they’re going to compete with Hulu, but consumers spend an inordinate amount of time looking for shows, and [the TV makers] get to sell 100% of their FAST channels.”

“Remember Roku didn't show up in the Gauge report forever, and now they are making a ton of money with that service,” Bloom added.

Roku is an interesting case study for the TV-makers. The company’s platform business jumped 17% in Q1, though guidance was shaky because of the tariff situation.

Unlike the TV-makers, Roku’s apps and ad tech cut across the entire TV ecosystem (not just one kind of TV), which would seem to give it an advantage when talking to advertisers. However, Roku opted out of a big NewFront and big slate of originals this year - instead opting to spend $185 million to snatch up the fledgling streaming service Frndly TV, which should provide it with an instant infusion of ad inventory.

They are sort of going after YouTube

“We are betting big on creators,” said Samsung’s Nelson. “This is the next era on FAST.” Samsung announced exclusive deals with big name YouTubers, including Mark Rober, Dhar Mann, Smosh and the Try Guys.

As I’ve written about, there is a lot of creator content coming to FAST. And these creators bring with them big audiences. Yet it remains to be seen whether viewers will gravitate to YouTubers via lean back FAST channel versus just watching them on YouTube. There is an argument to be made YouTube content is missing something without its social elements (sharing, commenting) - yet there’s also an argument to be made that YouTube viewing is becoming more lean back on TV.

One thought I had that may be - why does Google seem to be backing off its TV OS War? Is it because they’re already on every TV with YouTube?

They are trying to shape shoppable TV

These companies do have an enviable position here - given their ‘cross app’ ubiquity (you always use the same TV, not the same apps, so maybe you’d like to pay for things through your actual television?) And thus all of them are rolling out exclusive shopping ads. Amazon has had great success bringing together shopping data and TV advertising. Thus, Vizio’s new position in the Walmart family would seem to put them in a great spot.

Yet if you were looking for insights into how that will work, you didn’t find much during the Vizio NewFront. Walmart ad boss Seth Dallaire made an appearance, but mostly talked about how the two companies came together because they were both customer-first and innovative. Sigh.

It would seem to be a challenge for brands who want to push CTV shopping to be limited to the audiences of a single TV maker.

If nothing else, they seem committed

NewFront participants come and go (see AOL, Demand Media). So give credit to Samsung, LG and Vizio for coming back bigger every year. It will be interesting to see over time just how much these TV-makers parent companies want to invest in TV advertising - and in being legit media companies - to compete.

“They just have a lot of tentacles out there,” said one buyer. “The ad business is a good side hustle [now]. The data and tech side of the business is huge for these players who have a symbiotic relationship with the measurement side in the ad industry.”

Samsung, for one, gets that the ad industry loves a good show, as the company brought David Letterman and the Jonas Brothers to its event. “They got friggin David Letterman to show up,” said Bloom. “These guys are going to have a day. [Over time] it's balancing out the investment and make their home screens more interesting

“They don't have to win, they just have to keep increasing the value of their real estate.”

The thing that strikes me is that the business of manufacturing and selling TVs has become so low-margin that the OEMs need to get into data and ad sales to keep the business lucrative. I mean, look at Telly; their business model is all data, measurement and ad sales, and they GIVE the TVs away.