How AI could revolutionize what media gets produced -and have scary some side effects

The currency wars may be moot when the machines start learning and buying

As of January, a group of five major TV companies- including Fox, NBCUniversal, Paramount, TelevisaUnivision and Warner Bros. Discovery - are working together to develop a set of standards around new measurement technologies. The so-called JIC (Joint Industry Committee) plans to collect data, conduct analyses and set up audits for metrics companies ranging from iSpot to VideoAmp to EDO to incumbent Nielsen, according to Axios.

Given the complicated nature of these discussions, the manual work likely needed, and the conflicting agendas involved, I’d guess that the JIC isn’t likely to be handing out certifications over night.

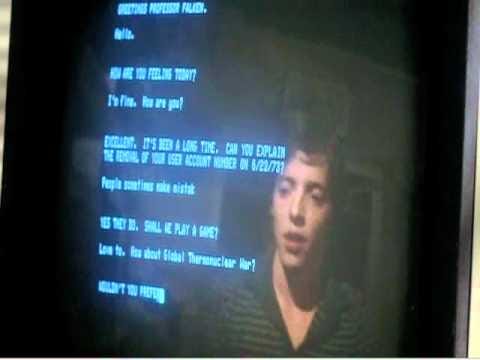

I’m starting to wonder why the group doesn’t just hand over its work to ChatGTP and see what it comes up with. What’s the worst that can happen? (Ok, hold that thought).

Ok, so while AI may be ready for writing quizzes for BuzzFeed, but evaluating media research firms is likely too tall of an order. For now.

I’m starting to wonder what happens when AI can not only help an advertiser figure out which metrics to use, but exactly which consumers to target, media properties to buy, levels to spend at - pretty much everything that media buying agencies do.

“This couldn’t be more perfect of a problem for a computer to solve,” said Jonah Goodhart, founding investor in Right Media and co-founder of Moat.

That could change - well - the entire media and advertising landscape - forever.

Next in Marketing is hosted in partnership with Adelaide, the leading attention measurement company. Don’t rely on 50% in view for 1 second to drive advertising impact. Adelaide’s omnichannel metric is used by some of the world’s largest brands to measure media quality, optimize towards placements that capture more attention, and most importantly, achieve better business outcomes.

This past week, I had a special three-guest episode of my podcast which was meant to be something of a debate on Attention as an ad metric and potential media currency. The group included Joanne Leong, SVP, dentsu international, Julian Zilberbrand, EVP Advanced Media, Paramount, and Marc Guldimann - Founder & CEO - Adelaide - a company that is focused on building attention measurement tools.

The discussion actually wasn’t centered on AI, but rather the question as to how exactly Attention can be measured effectively and become a media currency for both TV and digital - especially as both media are going through massive change. TV is already in middle of a huge currency battle to potentially replace Nielsen, while digital advertising is grappling with how ad targeting works in a privacy-focused world with no cookies or mobile IDS.

Isn’t this a bad time for another new metric, I wondered.

It was interesting to see the different sides of the business examine this issue. Dentsu’s Leong said the agency has been researching attention data intensely for five years, and has found it to be of great value. “Ultimately at the end of the day what we want to do is drive outcomes,” she said. “Attention is a huge predictor of those outcomes.”

So much so that Leong said that it may be time for a “currency correction” in the industry. That’s no small thing.

Meanwhile, Paramont’s Zilberbrand was - less than bullish. He noted that as of today, there are few standards and practices for buying and selling attention, and a ton of variables. Publishers can deliver an audience, but they can’t predict for lousy creative, or the sentiment of their viewers, for example. Attention might work for banners, he said, but as for TV, “The market will decide…I don’t necessarily see it as a currency at this stage.”

It’s true that ultimately, the market - meaning brands with money - ultimately decides these things. Already, NBCU is conducting tests using attention metrics as currency.

But at some point, humans may not even be making such judgements - which brings me back -finally - to Goodhart and AI.

Industry veterans will note that in the mid 2010s, Goodhart’s company Moat helped establish viewability as a key metric in digital media, causing publishers and brands to adapt new ways of presenting and tracking digital ads.

So you might expect Goodhart to be gung-ho about Attention metrics forging a similarly transformative path.

Yet in our podcast conversation, Goodhart noted “I don’t think it’s gonna happen in they way people think.”

“We need to understand quality of the exposure in digital,” he added. Attention is critical, but it’s variable, hard to define, and relative, Goodhart added.

Instead of a currency correction, Goodhart predicts that the future media planning and buying process will likely see brands/buyers plugging into some sort of dashboard which lets them pull in whatever metrics they need for given buy or campaign, rather than settling a new currency or currencies.

For example, NBCU is testing close to 200 different metrics partners. If we as an industry pick one or two of those and crown them as the new currency, “we’re not gonna get it right,” Goodhart said. And we’ll miss out of on lots of innovation.

But AI will get it right, Goodhart believes.

Putting aside that such a dashboard doesn’t exist yet, or the fact that the industry’s plumbing likely can’t pull in data from a few hundred vendors to decide which banner a person should see, or which TV ad to show a viewer - what happens if Goodhart’s vision becomes reality?

In this world, media sellers may win or lose and have little understanding of why.

If media companies think Attention gives them a feeling of less control today, what happens when machine learning over time starts to score Paramount viewers or Peacock viewers as having markedly different values? What happens when web visitors are seen as completely bidworthy at one time of the day, and useless at other times - and nobody but the machines knows why?

Rémi Lemonnier, co-founder of the AI-ad focused firm SciBids, said we may be headed toward a future where big name media properties won’t just ‘make the plan’ but will have to constantly prove their value. “Advertiser budget has to be earned by constantly demonstrating good performances on campaigns,” he said. “A more efficient market will also give to emerging websites that manage to attract and engage high-value audiences a much faster way to success.”

Yeah I know, I’ve heard it all before from programmatic vendors claiming to be able to use ‘AI’ to show people the perfect ad based on store availability, emotional state and hundreds of other factors. I’ll believe it when I see it. Then again, we suddenly have Bing falling in love with New York Times reporters. Things are advancing - fast.

Lemonnier believes that with real AI across programmatic advertising, fraud and low quality ad inventory should get wiped out - you won’t be able to game the system so much. But you won’t be able to get by on because your site or TV network ‘fits the part.’

“Data segments will not be selected because they are part of a good marketing story but because they actually perform and are deemed to be worth the cost by an impartial algorithm,” he said. “This will put much more emphasis on the quality of the data, and will also allow advertisers to discover non-intuitive correlations.”

To me, the use of non intuitive correlations sound smart- and worrisome. Do media companies become even more disenfranchised than they’ve been in the programmatic era? Do media buying agencies get completely disrupted? Or does AI just make everyone’s lives easier? I could see this kind of buying have a huge impact on the kinds of publications, services and even shows that launch or even get funded (what if only ‘happy shows’ score high, for example).

John Donahue, programmatic ad veteran and co-founder of Up and to the Right, told me that the GroupMs of the world are unlikely to go out of business thanks to machine learning. But media companies will have to make adjustments, and try to find ways to make sure their ad space resonates with AI tools.

“Once you know you are allowed on a plan and spend starts trickling in, it behooves the publisher or media company to understand how the media is being measured so they can maximize the media they are offering for sale through the distribution channel to better enable that optimization,” he said. “It might very well mean there is a need on the publishes end to build tech or buy tech that can discover these trends sooner and at finer levels of granularity to takes best advantage of the velocity of optimization.”

It’s awfully hard to know where this is headed. But I know this. If brands think that AI will give them more information, better ROI, or get them closer to that right ad, right time, right person dream - they’ll use it without hesitation - and figure out the consequences later on.

At that point, the JIC may be up.