Are we sure that ad-supported streaming is really THAT big?

As you probe deeper into how CTV, things get murkier

I was talking to a prominent media executive the other day about the ongoing exuberance in the advertising world over the growth in ad-supported, and, well, he was in the mood to throw some cold water on the party.

Even as CTV is quickly on its way toward becoming a $20 billion market, things smell funny, this person argued, especially when it comes to CTV’s supposed “long tail.”

Doing some phone-calculator math, he wondered how CTV could ever absorb the $70 billion traditional TV ad market, let alone become a medium that can cater to millions of performance brands someday.

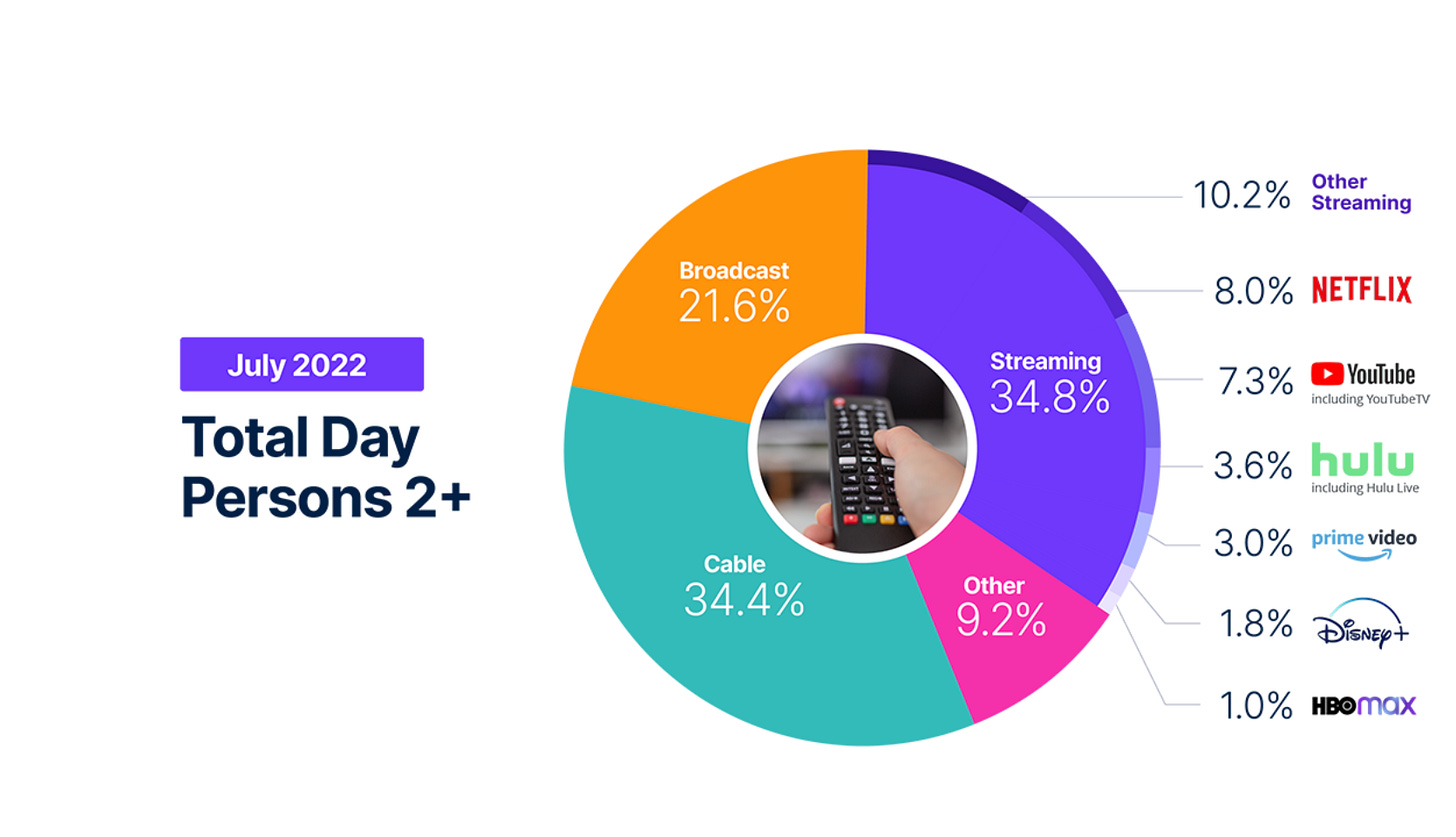

Wait a second, I countered. Didn’t CTV reach am impressive landmark this past July, as streaming viewership finally passed cable TV viewing in totality? Yes, but he was armed with caveats:

Half of streaming still isn’t ad supported, he said. Well, it depends on the measurement source you use, but it’s true that Netflix and YouTube remain the clear CTV leaders, with everyone else still fighting for to show up on the pie charts.

Fair enough. What about spending? Well, this person wondered - it you take the half of streaming that is ad-supported, how many of the dollars are soaked up by YouTube and direct deals with the bigger media players (Disney -Hulu, Fox + Tubi, Paramount+ Pluto, etc.), and how much of that market is left for programmatic channels?

Do the spending allocations correlate with viewing? Should they?

Ok I said, but what about all the big numbers from all these AVOD services? Surely that’s where the CTV programmatic growth is happening, right? Well, those numbers are self-reported, this person argued. If you add those audiences up, you’ll likely end up with more people that have televisions. We don’t have any real clue how many households watch Xumo or Tubi, or. the ad-supported channels on Samsung or LG TVs, let alone for how long or how frequently they do in a given month or week.

To be sure, this discussion was all very theoretical. And this wouldn’t be the first time that digital media created a market that benefited from confusion, misdirection and obfuscation. CTV is growing so fast, and the budgets are arriving quicker than the measurement and execution infrastructure common to most mature markets.

Case in point, there was an eye-popping story in the Wall Street Journal over the summer about how Roku and Amazon devices were delivering ads to TVs that were already shut off. It still feels crazy that this kind of thing is happening - and yet if feels totally expected, given the growth stage CTV is in.

For the latest episode of my podcast Next in Marketing, I sat down with Adam Gerber Executive Director, US Investment Strategy · GroupM and Mike Fisher, VP, Advanced TV & Audio at Essence the two executives who’ve spent 15 months trying to sift through this puzzle - to try and figure out what it means fo the medium as a whole.

It’s a fascinating story, one I think you’ll enjoy. As Gerber and Fischer walked me through how they uncovered this weird glitch, I came away with just how complicated, and muddled the mechanics of CTV are. And despite all of the great new data we have at our disposal, and the fact that CTV is delivered via the internet -which is supposed to make everything trackable, there is so much we don’t actually ‘know’ about how it works.

As Gerber explained, in any given CTV ad scenario, you can have three different players involved: a streaming device, a service/app, and a TV. That’s leads to potential gaps and variables, or a “game of telephone,” said Gerber.

“We should be doing better as an industry, he said. “It's really complicated. The question or the industry is ‘why aren't we paying more attention to this…given increasingly dependence on the streaming environment for advertising?’”

Indeed, it’s not just that individual campaigns numbers may be inflated due to sending ads to empty couches. As Fisher noted, several of his clients have been finding that CTV advertising hasn’t been as effective from an ROI perspective as you might expect, which set off alarms. Plus, he’s worried that bad initial data can lead to faulty metrics models going forward - which would hurt the medium overall.

To crack this particular case, Gerber and Fischer’s teams used ACR data from iSpot - numbers pulled from actual TV screens in 20 million homes. Which is great, but as Gerber learned, every TV manufacture collects that data just a bit differently, So he only knows how big this problem is on Vizio TVs. “There is still a lot of uncertainty.”

I wondered - as did the exec I mentioned earlier - does any of this give you guys pause? Could CTV not be as big as we actually thought?

Gerber thinks that may be a bridge too far. “The macro trend is streaming is growing by leaps and bounds,” he said . “There is no question in our minds.”

“As [CTV} growth occurs,” he added. “We need to be focused on how we’re going to measure it better.” That, he said will require the industry working together.

“We live in a complicated world…These problems aren’t going to change overnight.”

How are Roku and Amazon devices delivering ads to TVs that are already shut off? And how was that discovered? (I don't have WSJ.)